The Intersection of Big Data and Market Competition in Georgia

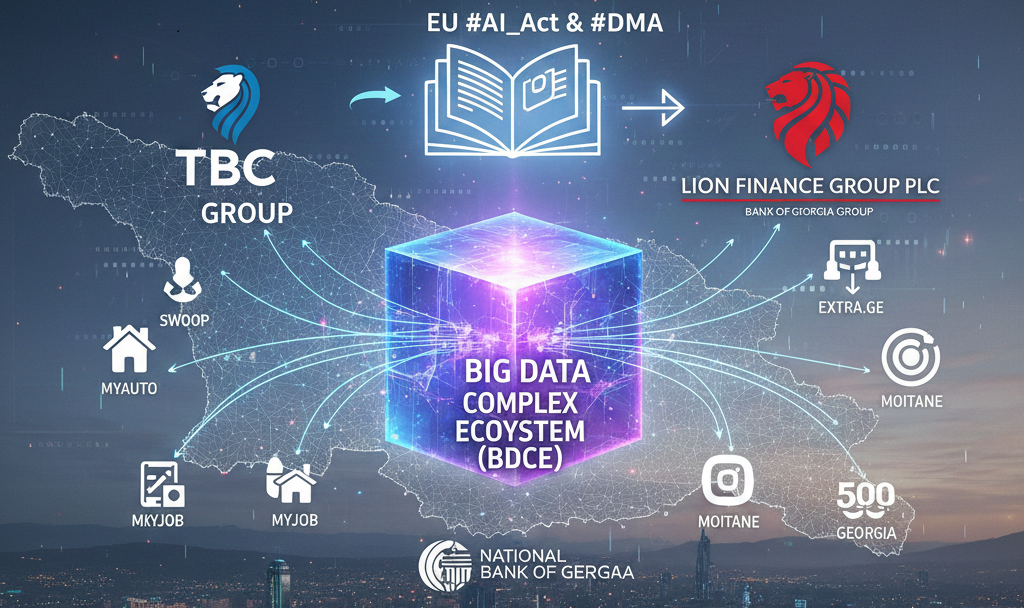

The digital ecosystem in Georgia has grown significantly, particularly where banking meets digital marketplaces. A key example of this is TINET (TNET) (a subsidiary of TBC Group) and #Digital Area, a subsidiary of Lion Finance Group PLC (aka Bank of Georgia Group). TNET, which acts as the administrator for major electronic platforms including Swoop, MyAuto, MyHome, and MyJob. Competing at the same scale, Digital Area's ecosystem is strategically built on five main business verticals:

Optimo: A lightweight POS and inventory management SaaS for retail and SMEs.

Extra.ge: The country's leading e-commerce marketplace.

Moitane: An on-demand delivery service for everyday goods.

Biletebi.ge: A dominant lifestyle and event ticketing marketplace. (https://digitalarea.ge/)

500 Georgia: A startup accelerator program in partnership with 500 Global, focused on scaling early-stage regional startups.

Ecosystem | Parent Company | Focus Areas |

TNET | TBC Group | Real Estate (MyHome), Auto (MyAuto), Jobs (MyJob), tickets (TKT.ge) & Lifestyle (Swoop) etc. |

Digital Area | Lion Finance Group (BOG) | E-commerce (Extra.ge), SaaS (Optimo), Delivery (Moitane), & Tickets (Biletebi.ge) |

𝙂𝙞𝙫𝙚𝙣 𝙩𝙝𝙚 𝙨𝙘𝙖𝙡𝙚 𝙤𝙛 𝙩𝙝𝙚 𝙂𝙚𝙤𝙧𝙜𝙞𝙖𝙣 𝙚𝙘𝙤𝙣𝙤𝙢𝙮, 𝙬𝙚 may 𝙘𝙡𝙖𝙨𝙨𝙞𝙛𝙮 𝙞𝙩 𝙖𝙨 𝙖 “𝙜𝙖𝙩𝙚𝙠𝙚𝙚𝙥𝙚𝙧.”

When you combine the specific data generated by these platforms with TBC’s reported customer base of nearly 3.5 million unique registered users and ~1.1 million digital monthly active users (MAU) (These figures are in TBC’s 2024 management report, published by National Bank of Georgia data as of 31 December 2024) TBC Bank (NBG) is one of the two dominant banks in Georgia’s banking sector, with a ~38–39% market share of total customer loans and deposits (according to NBG-referenced statistics). The result is the creation of 𝗕𝗶𝗴 𝗗𝗮𝘁𝗮 𝗖𝗼𝗺𝗽𝗹𝗲𝘅 𝗘𝗰𝗼𝘀𝘆𝘀𝘁𝗲𝗺 (#𝗕𝗗𝗖𝗘). /see: https://bit.ly/46c6qE7/

𝗪𝗵𝘆 𝘁𝗵𝗶𝘀 𝗺𝗮𝘁𝘁𝗲𝗿𝘀 𝗳𝗼𝗿 𝘁𝗵𝗲 𝗺𝗮𝗿𝗸𝗲𝘁:

• 𝗗𝗮𝘁𝗮 𝗖𝗼𝗻𝗰𝗲𝗻𝘁𝗿𝗮𝘁𝗶𝗼𝗻: If the banks and their corresponding companies, TNET and Digital Area, exchange customer data, the consolidation of banking data with user behaviour data from e-commerce, real estate, and employment sectors creates a distinct competitive advantage.

• 𝗥𝗲𝗴𝘂𝗹𝗮𝘁𝗼𝗿𝘆 𝗢𝘃𝗲𝗿𝘀𝗶𝗴𝗵𝘁: It is becoming increasingly relevant to ensure the GCCA • Georgian Competition and Consumer Agency is equipped with the legal authority and technical competence to properly assess this "big data market"—𝗕𝗶𝗴 𝗗𝗮𝘁𝗮 𝗖𝗼𝗺𝗽𝗹𝗲𝘅 𝗘𝗰𝗼𝘀𝘆𝘀𝘁𝗲𝗺 (𝗕𝗗𝗖𝗘).

• 𝗦𝘁𝗿𝘂𝗰𝘁𝘂𝗿𝗮𝗹 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀: If this concentration is found to have a restrictive effect on competition, we may need to discuss whether banking groups should hold such extensive ownership of digital platforms. Specifically, scholarly and regulatory discourse must address the systemic implications of financial institutions maintaining extensive ownership of multi-sectoral platforms. Such structures may grant incumbent firms asymmetric access to the Big Data market, potentially creating barriers to entry, distorting price discovery through advanced consumer profiling, and stifling innovation within the broader digital ecosystem.

In conclusion, the convergence of banking and digital commerce in Georgia has reached a tipping point, moving from simple service expansion to the creation of Big Data Complex Ecosystems (BDCE).

With TBC Group and Lion Finance Group (Bank of Georgia Group) controlling both the financial valves and the primary digital marketplaces (real estate, auto, e-commerce), they have effectively become the "gatekeepers" of the Georgian digital economy.

𝗟𝗼𝗼𝗸𝗶𝗻𝗴 𝗔𝗵𝗲𝗮𝗱:

For this purpose, to ensure a fair and competitive environment, it would be beneficial for the Parliament of Georgia to accelerate legislative approximation with EU standards. Specifically, aligning with the #AI_Act and the Digital Markets Act (#DMA) could provide the necessary framework to regulate these big data complex ecosystems effectively.

Does our current legislative framework have the tools to manage this level of data concentration, or is the rapid adoption of the EU's #DMA our only path forward?

What This Means for Everyday Georgians

The concerns are about an increasingly concentrated digital economy by banks in Georgia. Georgia's two dominant banks—TBC Bank and Bank of Georgia. Through their subsidiary ecosystems, they've expanded into nearly every corner of costumers online activity.

If a person uses TBC Bank, their subsidiary TNET likely touches your life through MyAuto (buying or selling cars), MyHome (finding apartments), MyJob (job searching), Swoop (deals and vouchers), TKT.ge (concert and event tickets), and MyMarket (online shopping). That's your housing search, car purchase, employment, entertainment, and shopping—all flowing through one corporate family.

Bank of Georgia's Digital Area operates the competing ecosystem: Extra.ge for e-commerce, Biletebi.ge for event tickets, Moitane for deliveries, and Optimo for business point-of-sale systems.

Why Should customers Care?

Customers’ financial and behavioural data could be merging.

When the bank that approves customer’s mortgage also might know what cars [s]he’s been browsing, what neighborhoods [s]he’s searching, and whether [s]he’s been job-hunting, that creates an extraordinarily detailed profile. This is a potential "Big Data Complex Ecosystem."

Consider a practical scenario: a person applies for a loan at a bank. In theory, they could know from MyJob that [s]he’s been actively searching for new employment (suggesting job instability), from MyAuto that [s]he’s been looking at expensive vehicles (suggesting spending habits), and from Swoop that [s]he’s been buying discount vouchers (suggesting budget consciousness). Whether banks actually use this cross-platform data for lending decisions isn't publicly documented, but the structural possibility exists.

Reduced competition and choice. When two conglomerates dominate both banking and digital marketplaces, new competitors face enormous barriers. A startup trying to launch a Georgian car marketplace isn't just competing against MyAuto's brand recognition—they're competing against a platform backed by a bank that can offer integrated financing, cross-promote across multiple platforms, and potentially offer preferential terms to users within its ecosystem. This can lead to less innovation, fewer choices, and potentially higher prices or fees over time.

Price discrimination becomes possible. With enough data, platforms can theoretically show different prices to different users based on their perceived willingness to pay. If a platform knows your income level, spending patterns, and urgency of purchase, dynamic pricing becomes technically feasible.

Practical Implications for Users

For now, awareness is your main tool.

Understand that when you use platforms owned by your bank's corporate group, you're potentially contributing to a comprehensive profile. This isn't necessarily harmful, but it's worth knowing.

Diversification offers some protection.

Using Bank of Georgia for banking but TNET platforms for services (or vice versa) at least prevents a single entity from holding both your financial and behavioral data. Using independent alternatives when they exist—smaller local job boards, independent real estate agents, direct ticket purchases from venues—reduces data concentration, though often at the cost of convenience.